Forever BPS Legacy Giving

Leave a Legacy Program for Bennington Public Schools through BPS Foundation.

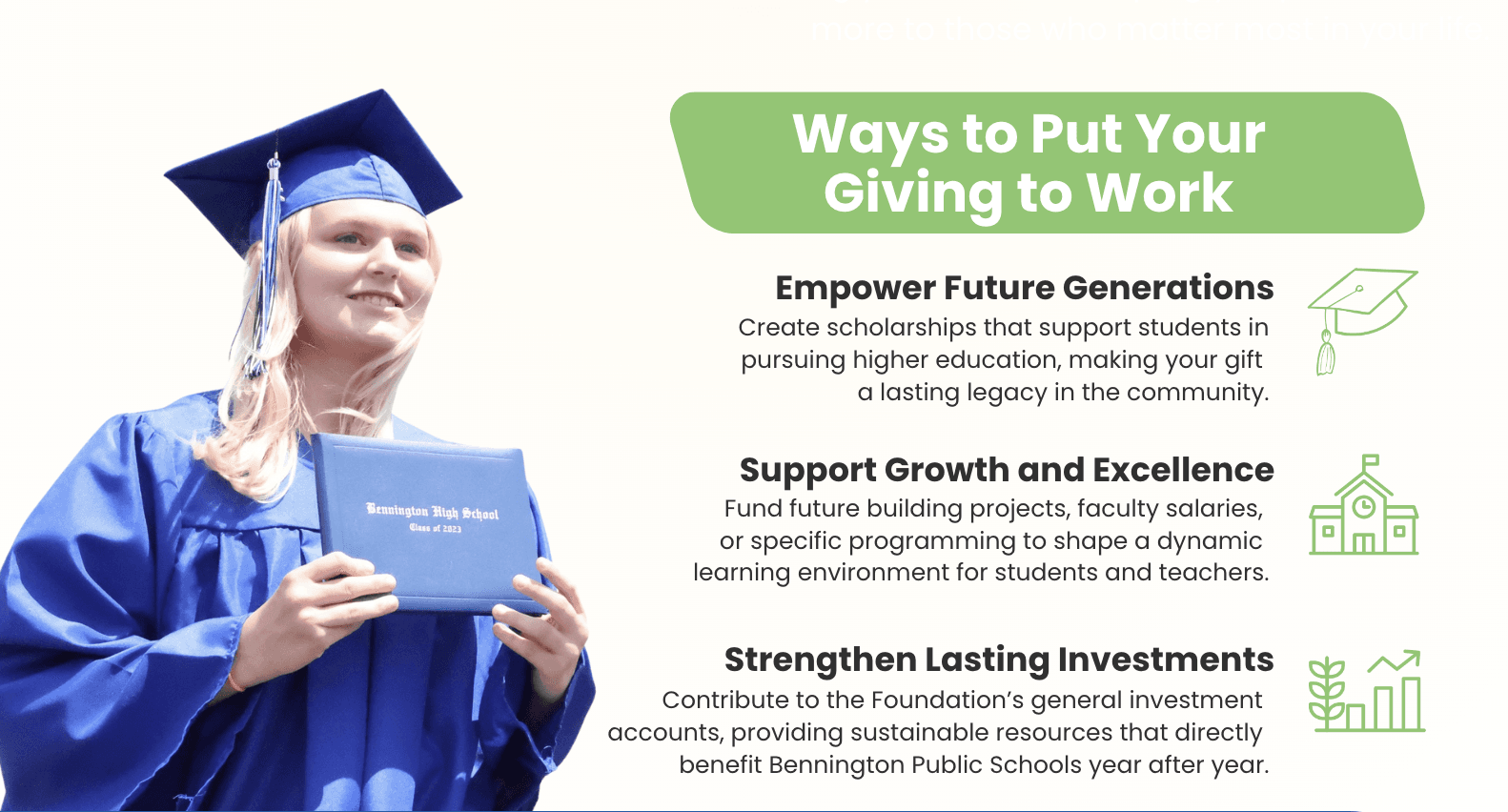

Planned giving comes in many forms and is a meaningful way to support the Bennington Public School District and 'Leave Your Legacy' – both now and for future generations.

Considering Bennington Public Schools Foundation in your plans allows you to make a lasting impact, with personal tax benefits during your lifetime—helping you pass on even more to those who matter most in your life.

Ways to Give

-

Endowments

Endowments leave a legacy in a name of your choice for a lifetime!

An endowment allows the earned interest annually to be used for your choice of use. Endowments can be tailored to a donor's preference to best meet their needs and wishes.Previous Examples: Lee & Kathy Bunz Endowment Senior Scholarship, Darrell & Coe Leta Endowed Senior Scholarships & Staff Professional Development Awards

-

Bequests

A simple way you can make a lasting difference is to designate Bennington Public Schools Foundation as a beneficiary in your will or living trust. Your bequest can be an outright gift of a specific amount or a percentage of your residuary estate.

-

Life Income Gifts

As you look to retire, financial worries with family obligations, coupled with the high cost of living, can make it difficult for many people to consider substantial charitable gifts now. A life income plan allows you to make a gift now while receiving a yearly payment for your personal financial needs. The three basic types of these plans are charitable gift annuities, charitable remainder trusts, and charitable lead trusts.

Advantages of life income gifts include:

- It pays you, your beneficiary, or both, an income for life and in many cases, a larger income than the gift property is presently earning for you.

- It can offer an immediate charitable deduction.

- You can avoid capital gains tax upon sale of any appreciated assets.

- You will have an eventual estate tax savings.

- It relieves you of the burdens of asset management and enables you to support, in a significant way, the program of your choice.

-

Life Insurance Policies

The easiest way to make a gift of life insurance is to include a percentage (1%, 5%, 10% or more) to Bennington Public Schools Foundation as a part of the primary beneficiary designation. This is referred to as a "Life Share" gift and is fully revocable. Substantial gifts can also be made by making the beneficiary of a new policy or an existing policy that is no longer needed. In this event, premiums paid by the donor to continue coverage are tax deductible.

-

Gifts of Real Estate

Depending on the circumstances involved, gifts of real estate can be an effective means of planning a gift. While the first thought often is a home or farm, real estate also can involve a vacation home, an apartment or commercial building, a shopping center, or undeveloped land. Each piece of property and its unique circumstances need to be reviewed to determine the suitability of the property as a gift. Generally speaking, an acceptable piece of property is one that can be readily sold.

-

Payable on Death (POD) Notes

This simple revocable arrangement can be attached to a variety of assets (IRA's; CD's; TSA'S; TDA'S; annuities; employee savings plans; etc.) to facilitate a gift after the lifetime of the owner(s).

Interested in discussing? Contact Executive Director Blake Thompson at 402.238.3044 or BThompson@bennps.org.

Current Forever BPS Legacy Gifts

-

Darrell & Coe Leta Logemann Endowed Senior Scholarships

-

Darrell & Coe Leta Logemann Endowed Staff Professional Development Grants

-

Lee & Kathy Bunz Family Endowed Senior Scholarships

-

Gene Baldwin Memorial Senior Scholarships

-

Jeff Glover Memorial Scholarship

-

Dave Clark Memorial Scholarship

-

Larry Saunders Memorial